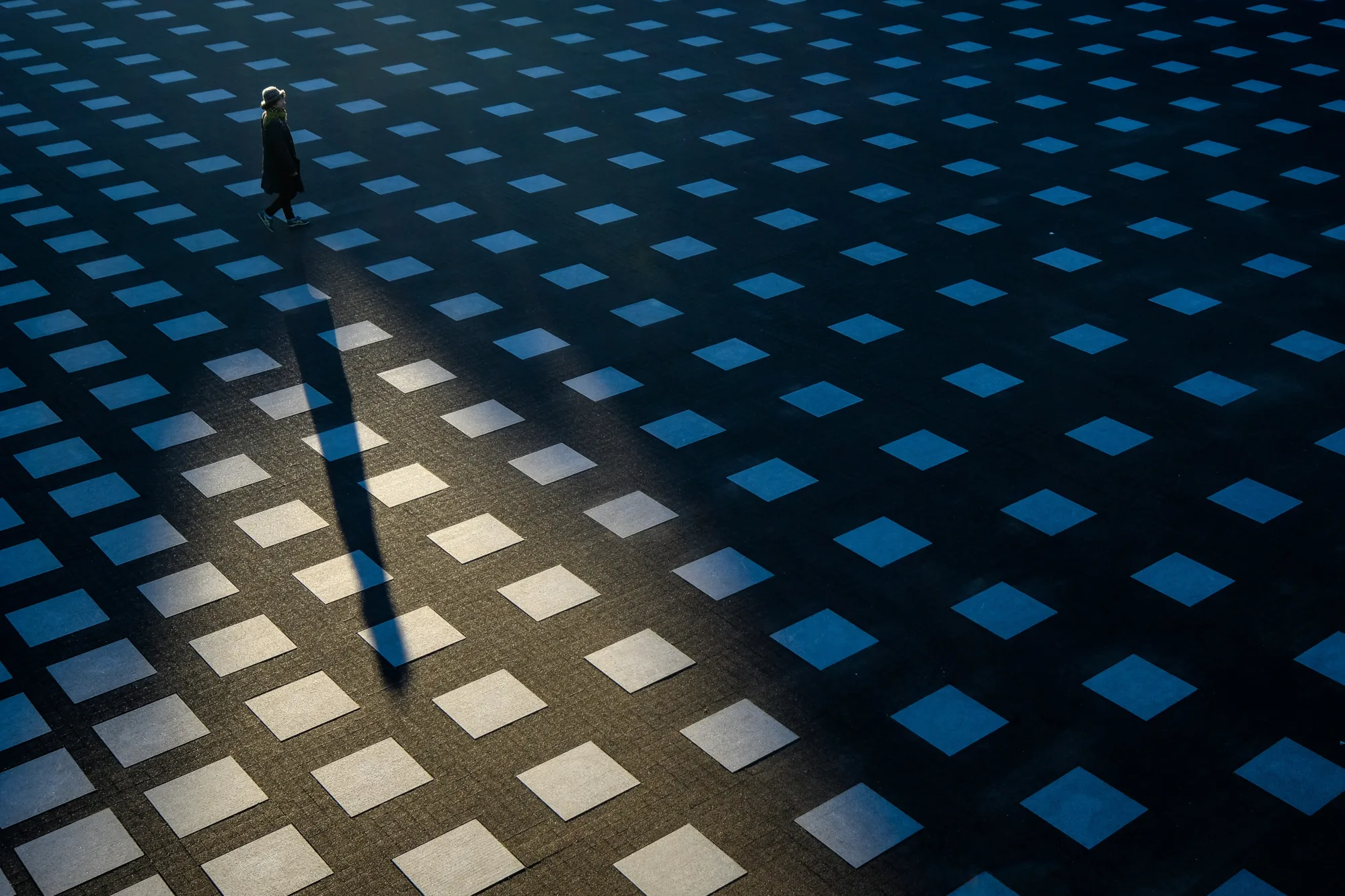

The right leader doesn’t just deliver returns, they redefine the exit trajectory.

Leadership as the New Alpha

In private equity, leadership isn’t just a support function, it’s a value creation lever. The right CEO can compress timelines, drive operational efficiency, and reframe the exit horizon. The wrong hire, conversely, can stall growth, miss targets, and compromise investor returns.

PE-backed firms operate with intensity, urgency, and outcome focus. This calls for a different breed of leader, high-impact, adaptable, and intimately aligned with the investment thesis.

What Makes Leadership in PE Different

The executive profiles that thrive in PE environments share a unique blend of traits

- Operational acumen with investor fluency

- Agility to pivot and scale rapidly

- Entrepreneurial mindset paired with financial discipline

- Alignment with the investment arc from acquisition to exit

Advisory Perspective

Private equity is no longer only focused on operations and margins, people capital is now a primary differentiator. The first 100 days of new leadership can define the full cycle of growth and exit planning.

The Executive Arc of PE Success

Leadership Lifecycle Overview

- Pre-Investment Readiness

Leadership due diligence is critical. Assessing cultural fit, succession gaps, and leadership risk pre-deal prevents value leakage post-close.

- Post-Acquisition Buildout

Speed is key. Aligning the top team within the first 90 days accelerates integration and unlocks early wins. - Mid-Cycle Optimization

As strategies evolve, so must leadership. High-performing PE firms reassess and recalibrate talent midstream to maintain performance velocity. - Exit Alignment

Whether IPO or strategic sale, leadership must be aligned with the exit vision. A misaligned C-suite can affect valuation and transition success.

Building a PE-Ready Leadership Architecture

We support PE firms across the full deal cycle, sourcing executives who deliver fast ROI, aligning leadership with value creation goals, and structuring C-suites for scalable growth. Precision in leadership isn’t optional, it’s the multiplier that transforms investments into outcomes.

Featured Insights

Building Boards That Shape the Future

Why progressive board composition is key to resilience, innovation, and stakeholder trust.

From Assessment to Acceleration

Reframing leadership potential through data, behavioral science, and strategic foresight.

Elevating Human Capital to a Strategic Asset

Why advisory on talent, culture, and capability is a boardroom priority.